Buying uncompleted properties is like buying stocks. Everyone knows to choose high-quality stocks. This kind of stocks can lead the rise when the market rises, and can resist the fall when the market falls. The same goes for investing in uncompleted flats. You must also choose good uncompleted flats and good condos. The real estate market is in a period of upswing, with the largest increase. When the real estate market is in a downward channel, the value can be preserved or the decline is not so much. So how do I choose to invest in uncompleted projects?

First: choose famous brand developers

Brand-name developers generally have a long history. They have accumulated a lot of funds and experience in the construction industry for many years. They are also mature in technology and management, and they are easy to get a good location. The landmark buildings in Toronto are all built by famous developers. For example, ONE BLOOR of GREAT GULF, AURA of CANDEREL, 10 YORK of TRIDEL, etc.

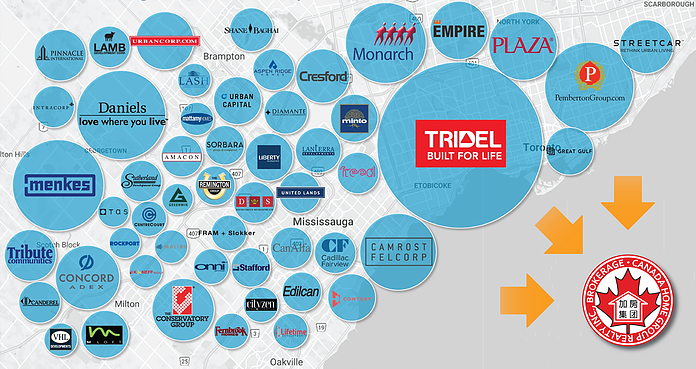

Brand-name developers generally have their own construction team to ensure construction quality. Brand-name developers have many years of relationships with suppliers of construction materials such as cement and steel, and they can get good prices. Large developers may have multiple projects underway at the same time, and the demand for building materials is relatively large. For building material suppliers, such customers are more important. Therefore, the price can be guaranteed in terms of timely delivery. Brand-name developers value their own reputation more seriously, so they are more assured in terms of after-sales service. In terms of property management, some developers like TRIDEL have their own property management companies, which do better in terms of management quality. With good location, good quality, good management and good supporting facilities, such real estate will be sought after by buyers. To maintain and appreciate in value, here are some of the more famous developers in Toronto:

- TRIDEL

- MONARCH

- CONCORD

- DANIEL

- MENKES

- MINTO

- CANDEREL STONERIDGE

- GREAT GULF

- LANTERRA

- EMPIRE COMMUNITIES

- REMINGTON

- LIBERTY

- FERNBROOK

- CONSERVATORY GROUP

- LIFETIME DEVELOPMENTS

- CITYZEN DEVELOPMENTS

Second: choose a convenient location

The first is along the subway, or close to the main traffic intersection of the subway, it is better to walk to the subway station within 3-5 minutes. For DOWNTOWN TORONTO, along YONGE, BAY, UNIVERSITY, CHURCH, JARVIS, SHERBOURNE, BLOOR Street, MIDTOWN is near the YONGE/EGLINTON intersection, North York’s YONGE Street Corridor, ETOBICOKE’s KIPLING, ISLINGTON subway stations, and nearby Near SQUARE ONE in the city, along the SHEPPARD in North York, the above locations are good locations for investment and real estate. Of course, other locations are not possible. If the location is slightly off, the price is very cheap, which means that the price is good. It is also a good place for investment, such as the KING WEST area in the past few years.

Third: The place where the real estate is built must be densely populated

All human industries and business activities exist to meet human needs. In North America, humans follow work. Where there is a job, people will move there. Because of the development of the petroleum industry, CALGARY has developed. Then more oil workers came, and the supporting industries of the oil industry also came, hiring more workers. Then the tertiary industry that served these workers also developed, and the demand for real estate was also driven. Numerous demands have promoted the rise of house prices in Calgary. The negative example is Detroit, the city of autos that used to be the most beautiful city. With the decline of GM, Ford and other auto giants, a large number of workers were unemployed, the population was lost, and the real estate depreciated. Good investment real estate must be in a relatively densely populated place. In this kind of place, because there is a lot of demand, renting and selling are relatively fast. Active trading and good liquidity can ensure the preservation and appreciation of real estate.

Fourth: work, study and life are more convenient

According to zoning, the area must have RESIDENTIAL ZONING, COMMERCIAL ZONING, LIGHT INDUSTRIAL ZONING, etc.

In addition to convenient transportation, a good investment property should also be convenient in other aspects of work and life. A good investment property usually has the following two or more functional areas nearby.

Work area: such as office building, bank building, hospital building

Study area: such as university, middle school, elementary school, library,

Shopping area: such as supermarkets, clothing stores, convenience stores, various restaurants, coffee shops

Entertainment area: such as bars, cinemas, theaters,

Recreation areas: such as community centers, parks, ice hockey rinks, fitness clubs, museums, galleries

Toronto YONGE/BLOOR is a very typical example. There are several office buildings such as 2 BLOOR WEST nearby. It can be as big as a few minutes’ walk. There is BLOOR STREET WEST shopping area, TORONTO REFERENCE LIBRARY, coffee shops, bars and restaurants on CUMBERLAND and YORKVILLE streets. There are lots of ROM (Royal Ontario Museum) on AVENUE/BLOOR, QUEEN PARK is a park, and BLOOR/YONGE subway station is a two-line subway station, so although the prices of the nearby properties are not cheap, they are very popular, such as BLOOR ONE, CASA1, CASA 2, YORKVILLE, EXHIBIT.

Upper and lower bunks are the most primitive and simple form of MIX-USE. There are a large number of upper and lower bunks in DOWNTOWN in many cities in North America. There are also many upper and lower bunks in TORONTO DOWNTOWN, and they are very common in China. In recent years, the number of MIX-USE BUILDING in Toronto has been on the rise, but the form has become in one building. There are various shops downstairs, and houses or offices upstairs. A typical example is the Maple LEAF SQUARE by the DOWNTOWN lake. In its 9-storey podium, there are shops such as LONGO'S supermarket and other bars. There is a four-star hotel LE GERMAIN, with residential units upstairs and direct access from downstairs. Union Station, opposite TELUS CENTRE and Air Canada Center. The 33, 35EMPRESS, and 8HILLCREST built by North York’s MENKES company are familiar examples, direct access to the subway, downstairs supermarkets, restaurants, cinemas, prestigious schools MCKEE, EARL HAIG. Several buildings that have been selling hot recently are of this type, such as HULLMARK CENTRE, 1000 BAY, THE BOND, TABLEAU, etc. The MIX-USE building, which has a good location and convenient transportation, is sought after by investors and END USER, just like blue-chip stocks, which can maintain and appreciate. Like 8HILLCREST, although it is an old building more than 10 years old, some units are now sold at close to 800/sf, which is higher than all the new buildings nearby. YONGE/SHEPPARD’s EMERALD PARK CONDO is now on the market at 780/sqft, which is also a lot higher than the previous VIP price of about 450. AURA has recently added 3 floors. The 39th floor has been sold at 950/sqft, compared to the previous VIP price. That is about 550, the price of MAPLE LEAF SQUARE when it opened was only 450/sq. ft. Now some units are priced at 900/sq. ft., and trading is very active. At that time, other buildings sold 450/sq. ft., but now they can only sell 750/sq. Chi, ICE1 and ICE2 developed by LATERRA next to MAPLE LEAF SQUARE are also directly connected to PATH, subway, and commercial and residential. They are very popular when they open, and they are sold early. Therefore, a good off-plan with appreciation potential must be in a MIX USE area, or it is a MIX-USE building.

Fifth: There must be a very high WALKSCORE

WALKSCORE.COM is a walking scoring website that can calculate the walking index from any house address to nearby living facilities to help find a walkable residential area. It evaluates residents’ walking to nearby supermarkets, restaurants, schools, Whether parks and other facilities are convenient, we have created a walking index to analyze life functions. The index is between 0 and 100 points. The higher the score, the more convenient life is. A score of 90 or more is ideal. WALKSCORE in many places in DOWNTOWN Toronto Very high, such as YORKVILLE, ENTERTAINMENT DISTRICT, etc. A company in the United States found through an investigation that, in such a downturn in the US real estate market, those communities with high WALKSCORE are more valuable than those with lower WALKSCORE. Where the WALKSCORE is high, the traffic on the streets is large, which has a deterrent effect on criminals. The community is also relatively safe.

Sixth: Do not choose real estate with too low floors

Generally speaking, the lower the floor, the shorter the delivery time. As a real estate investment, it is generally necessary to choose a building above 20 floors. The investment time is preferably 3-5 years. For buildings with too few floors, the price may be delivered too early. It hasn't risen yet. Generally, after 3-5 years, if the market is normal, most of the uncompleted units will have a certain increase. When the house is delivered, you can sell or rent it out. Therefore, when choosing an investment real estate, it is best to choose a real estate with more than 20 floors and delivery in 3-5 years.

In short, a good investment real estate must be developed by a good developer, located in a densely populated place, with a high WALKSCORE, convenient transportation, and a variety of MIX USE buildings in or nearby. For example, MAPEL LEAF SQUARE, AURA, 1BLOOR, HULLMARK CENTRE, etc.